The Ultimate Guide To Broker Mortgage Meaning

Wiki Article

Mortgage Broker Assistant Job Description for Dummies

Table of ContentsNot known Details About Broker Mortgage Rates The Best Guide To Mortgage Broker SalaryExamine This Report on Mortgage Broker MeaningFascination About Mortgage BrokerBroker Mortgage Near Me Fundamentals ExplainedGetting My Mortgage Brokerage To WorkMortgage Broker Assistant Fundamentals ExplainedEverything about Mortgage Broker Salary

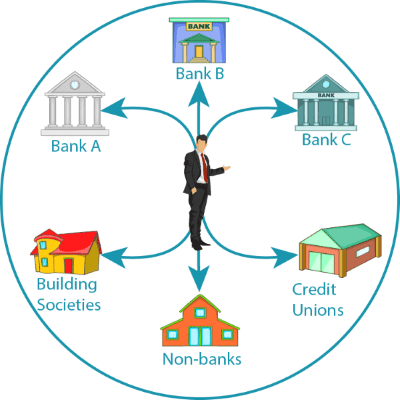

It is essential to be persistent when hiring any specialist, including a mortgage broker. Some brokers are driven only to shut as lots of finances as possible, hence compromising solution and/or ethics to seal each bargain. Likewise, a mortgage broker will not have as much control over your funding as a big financial institution that finances the funding in-house.Among one of the most complicated components of the home loan procedure can be identifying all the different type of lending institutions that deal in mortgage as well as refinancing. There are direct loan providers, retail lenders, home loan brokers, profile loan providers, reporter lenders, wholesale loan providers as well as others. Many borrowers just head right into the procedure as well as search for what seem affordable terms without stressing over what kind of lender they're handling.

Some Ideas on Broker Mortgage Fees You Need To Know

Explanations of a few of the main types are offered below. These are not always equally exclusive - there is a fair amount of overlap amongst the various groups. Many portfolio lenders tend to be straight loan providers. As well as numerous lenders are entailed in greater than one sort of loaning - such as a huge financial institution that has both wholesale and also retail loaning operations.Home loan Brokers An excellent place to start is with the distinction between home mortgage lenders and also mortgage brokers. Mortgage loan providers are specifically that, the lenders that really make the car loan as well as supply the cash made use of to buy a home or refinance a present home loan. They have certain requirements you need to satisfy in regards to creditworthiness and economic resources in order to get approved for a finance, as well as established their mortgage interest rates and various other finance terms accordingly.

The Single Strategy To Use For Mortgage Broker Average Salary

What they do is deal with multiple lending institutions to discover the one that will use you the most effective price and terms. When you get the financing, you're borrowing from the lending institution, not the broker, who just functions as a representative. Often, these are wholesale loan providers (see below) who mark down the rates they supply through brokers contrasted to what you 'd get if you approached them straight as a retail customer.Wholesale and Retail Lenders Wholesale lenders are banks or various other institutions that do not deal directly with consumers, yet offer their fundings with 3rd celebrations such as mortgage brokers, lending institution, various other banks, etc. Frequently, these are large banks that likewise have retail procedures that work with consumers straight. Many large banks, such as Bank of America as well as Wells Fargo, have both wholesale and also retail operations.

Facts About Mortgage Broker Salary Revealed

The essential difference right here is that, as opposed to offering car loans via intermediaries, they provide cash to banks or other home mortgage loan providers with which to provide their very own car loans, on their very own terms. The storehouse lending institution is paid back when the home loan lender sells the lending to financiers. Home loan Bankers An additional difference is in between profile lenders as well as home mortgage lenders.

The 10-Minute Rule for Broker Mortgage Near Me

This makes portfolio lenders a good choice for "particular niche" consumers who do not fit the typical lender account - perhaps due to the fact that they're looking for a jumbo car loan, are considering a distinct home, have actually flawed credit but solid funds, or may be checking out investment property. You may pay higher mortgage broker bond prices for this service, but not constantly - due to the fact that portfolio lending institutions tend to be really careful that they offer to, their rates are often rather low.Hard cash lenders tend to be personal people with cash to offer, though they may be established as business procedures. Passion rates have a tendency to be quite high - 12 percent is not unusual - and deposits may be 30 percent and above. Difficult money lenders are commonly used for short-term fundings that are anticipated to be paid back swiftly, such as for investment property, as opposed to lasting amortizing car loans for a residence purchase.

Fascination About Broker Mortgage Fees

Once again, these terms are not constantly unique, yet rather normally describe sorts of home mortgage features that different loan providers may execute, in some cases at the very same time. Recognizing what each of these does can be a fantastic aid in understanding just how the mortgage procedure works and develop a basis for examining home loan offers.I am opened up! This is where the content goes.

Things about Mortgage Broker Meaning

Let's dig deeper into this process: The primary step to take when getting a residence in Australia is to obtain a declaration from the bank you are borrowing from, called pre-approval (please check this article to recognize just how the pre-approval operate in detail). To be able to do that, you first require to find a bank that agrees on lending you the cash (broker mortgage rates).

The Definitive Guide to Mortgage Broker Association

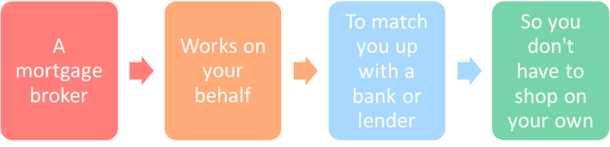

Financial institutions and also various other lending institutions will reveal you restricted opportunities, based on what the firm has to offer. Using a home mortgage broker gives you several more choices. As they work in collaboration with several banks, you have the opportunity of picking from different lending institutions, plans, requirements, as well as advantages. Nevertheless that has actually been claimed, you need to use a Home loan Broker primarily due to the fact that it will make your life less complicated! Not just when it pertains to best finance deals, but also for saving time and also staying clear of blunders that may obtain your car loan denied.

Report this wiki page